ISE06/20-21

| 主題: | 民政事務、福利服務、慈善機構 |

- 香港社會以樂善好施見稱,免稅慈善捐款在18年間飆升3倍,於2019年達到127億港元的歷史新高。然而,政府對本港約9 200個慈善機構的監管頗為寬鬆,規管職責散布18個政策局與部門。1註釋符號代表香港政府一站通(2017年)。 在缺乏協調下,慈善機構的監管有欠周全,以致本港不時出現慈善機構管理不善及行為不當的報道,當中包括不當使用公眾捐款,以及在政府以免租或優惠租金批出的土地上經營酒店牟利。2註釋符號代表2013-2015年期間,傳媒報稱共有14幅批給慈善機構的土地,被用作經營酒店。由於其中3幅土地是以沒受任何限制的土地契約批出,審計署只檢視餘下11幅土地,並發現有商業經營的跡象。請參閱Audit Commission (2017)。 這些醜聞不僅削弱市民對慈善機構的信心,亦令公眾廣泛關注到現行規管制度"東拼西湊,缺乏成效"。3註釋符號代表Office of The Ombudsman (2003)。

- 2003-2019年期間,多達5個本地公共機構曾檢討慈善機構規管制度,當中包括申訴專員公署、廉政公署、法律改革委員會("法改會")、審計署和政府帳目委員會。大部分機構均建議設立更全面的監管制度,以:(a)建立紀錄冊,列出符合法律定義的慈善機構;(b)規管該等機構的籌款活動;及(c)保障公眾捐款得以善用。其中法改會更提出成立單一規管機構,執行上述建議;然而,政府卻在2017年對此表示強烈保留意見,原因是社會"未有共識",而部分慈善機構亦關注到擬議機構的權力範圍。4註釋符號代表HKSARG (2017)。 基於此原因,政府改為推行若干行政措施,提高籌款活動的透明度。

- 全球多個先進地方(例如澳洲、新加坡和英國)亦曾推行規管改革,以加強慈善機構的問責性和透明度。具體而言,澳洲在2012年改變其規管方式,由過往的分散規管方式,改為集中規管模式,對香港應具一定政策參考價值。本期《資訊述要》先簡述本港的慈善機構規管制度,繼而討論澳洲的相關規管改革。

香港慈善機構的規管制度

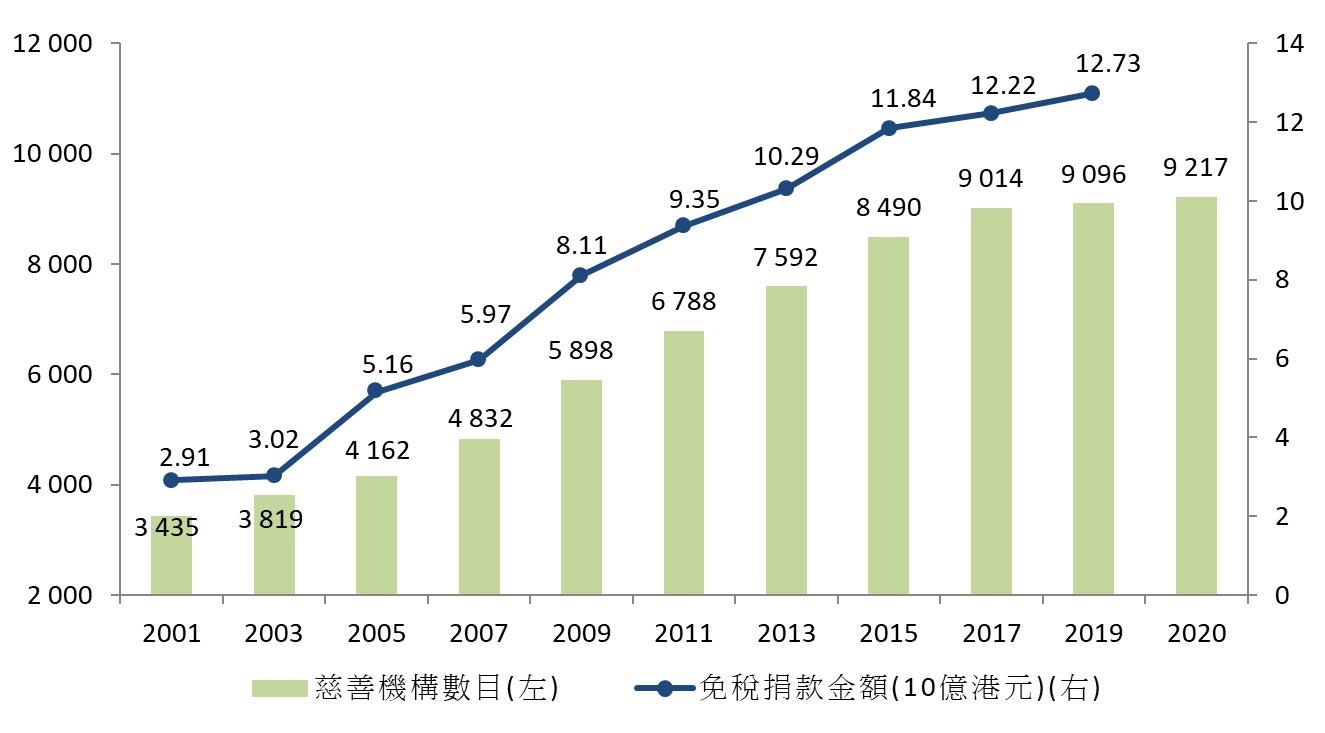

- 慈善機構數目急增和龐大公眾捐款:自2001年以來,在稅務局註冊獲豁免繳稅的慈善機構數目增加了168%,於2020年高達約9 200家(圖1)。公眾捐款的升幅更為顯著,累升337%至2019年的127億港元,佔本地生產總值的0.4%。5註釋符號代表不包括其他形式的捐款,例如獲社會福利署許可的賣旗日及其他籌款活動所得的收益。過去10年,相關款額每年平均約有2億港元。請參閱Audit Commission (2017)。 根據2018年的慈善捐款參與度全球排名榜,香港於在146個地方中高居第18位。6註釋符號代表Charities Aid Foundation (2018)。 圖1 - 香港的慈善機構及免稅捐款(1), (2)

- 零散的規管制度:香港現時並無"慈善機構"的法定定義,亦無專門規管慈善機構的法例或專職的單一規管機構。有關慈善機構的法例條文,主要見於《稅務條例》(第112章),它經1949年及1970年修訂後,為符合"慈善宗旨"的機構及慈善捐款提供稅項豁免。7註釋符號代表Public Accounts Committee (2018)及Inland Revenue Department (2020a及2020b)。

儘管如此,本港共有9個政策局和9個政府部門,直接或間接涉及慈善機構的監管工作,其規管範圍則視乎慈善機構的性質和活動。以慈善機構的法律形式為例,假如該機構以公司形式註冊,由公司註冊處負責監督;但如有關機構註冊為社團,則由警務處監管。至於籌款活動,賣旗活動由社會福利署("社署")規管;而奬券活動則由民政事務總署("民政總署")規管。若慈善機構尋求政府支援,則由稅務局處理稅項寛減事宜,地政總署負責批地,其他部門提供相關資助(例如由教育局向促進教育的慈善機構提供資助)。 - 主要規管漏洞:在沒有專職機構監管慈善機構的整體管治下,導致規管漏洞,並不時出現慈善機構的不當行為。首先,儘管慈善機構須向稅務局提交年報及財務帳目,以維持免稅地位,但即使該等機構涉及不當使用款項,稅務局亦無權撤銷其作為慈善機構的地位,亦無權要求其採取糾正措施。8註釋符號代表稅務局在以下情況,可推翻慈善機構的免稅地位,例如:終止運作、不回應其查詢及未能維持慈善性質。請參閱Audit Commission (2017)。 第二,由於政府無權規管某些新興籌款方式(例如網上捐款與自動轉帳捐款),慈善機構無須向公眾披露從這些渠道得到的捐款收益及用途。第三,雖然獲發政府資助的法定慈善機構一般受到較嚴格監管,但未有接受政府資助並以社團或信託形式運作的機構,只須接受最低程度監管。9註釋符號代表稅務局只要求慈善機構不時提交年報及帳目,通常每隔3年提交一次。請參閱Inland Revenue Department (2020b)。 第四,在缺乏一站式資訊平台的情況下,市民與捐款人難以監察逾9 200個慈善機構的管治及財務狀況。第五,《稅務條例》所指的"慈善宗旨",可追溯遠至1891年的英國案例法,主要包括濟貧、促進教育和推廣宗教等宗旨。10註釋符號代表機構如符合其他惠及公益的宗旨,亦可申請享有慈善機構地位,但根據稅務局的數字,這類機構只佔2019-2020課稅年度註冊慈善機構的15%。 不過,這些宗旨與現代社團的一些慈善宗旨(例如保護動物福祉和推廣人權)不盡相同,並對部分慈善機構的運作構成障礙。

- 慈善機構的不當行為個案:在2017年發表的報告中,審計署表示留意到最少有6個慈善機構曾不當使用款項,當中一個機構甚至在3年內向董事支付高達1,300萬港元的酬金。此外,至少11幅批給慈善機構的土地,被用作經營酒店牟利。其中一個慈善機構在3年內賺取合共7,000萬港元的利潤,而部分慈善機構更沒有向相關部門披露盈利狀況或提交財務報告。至於在2012-2016年期間進行的1 430次街頭籌款活動,當中三分之一的行政費用偏高,佔相關捐款收益20%以上。11註釋符號代表Audit Commission (2017)。 除此以外,新聞媒體亦不時報道慈善機構管理不善的事件。

- 近期發展:法改會在2013年提出18項建議,以處理上述規管有欠周全的問題,包括:(a)為慈善宗旨訂立法律定義,包含較新的宗旨類別;(b)建立慈善機構的中央註冊紀錄冊;(c)提高慈善機構的資訊透明度;及(d)長遠而言成立慈善事務委員會。12註釋符號代表Law Reform Commission (2013)。 2017年,審計署亦曾重提類似建議。13註釋符號代表Audit Commission (2017)。

然而,政府以社會上"未有共識"為由,未有落實上述大部分建議。不過,稅務局同時收緊對慈善機構的財務報告監管,並於2017-2018年度撤銷約370個機構的慈善機構地位。此外,當局在2018年8月及2019年4月推行若干行政措施,提高籌款活動的透明度,例如:(a)上載社署及民政總署轄下籌款活動的經審計帳目至公眾網頁;(b)推出電話專線,供市民查詢;及(c)引入標識,讓公眾識別經許可的籌款活動。14註釋符號代表GovHK (2018及2019)。 據報,民政事務局仍在整合各部門對進一步改革慈善機構整體規管的意見。15註釋符號代表HKSARG (2019及2020)。

| 註:(1) | 2003年起的款項包括可獲豁免繳納薪俸稅、利得稅及個人入息課稅的捐款。2001年金額則只包括前兩類稅項豁免。 |

| (2) | 截至每年3月31日。 |

| 資料來源:Inland Revenue Department。 | |

澳洲近年的慈善機構規管改革

- 澳洲的慈善事業相當蓬勃,在2019年共有57 900個慈善機構。澳洲民眾在2018年的慈善機構捐款高達105億澳元(615億港元),佔其國內生產總值的0.6%。16註釋符號代表ACNC (2020)。 根據上文提及的全球調查,澳洲民眾的捐款參與度於2018年全球排名第3位,僅次於緬甸及印尼。17註釋符號代表Charities Aid Foundation (2018)。

- 2012年前的分散規管框架:與香港相似,澳洲在2012年前對慈善機構的規管流於分散,由聯邦及各州多個規管機構負責監管慈善機構不同事宜(例如稅項豁免、法律形式及籌款活動)。例如,當地有19個機關分別根據178條法例,參與釐定慈善機構的地位。18註釋符號代表The Treasury (2011)。 這不但導致規管要求不一致,而且欠缺效率。1980年代以來,隨着政府增撥資助,慈善機構迅速增加,該等機構卻承受沉重的合規壓力。19註釋符號代表Industry Commission (1995)及Murray (2019)。

- 規管架構的檢討:為回應日趨強烈的公眾要求,澳洲政府在1995-2011年間就慈善機構規管制度進行多達7次檢討。所有檢討結果均建議設立單一專職規管機構,協調相關規例。不過,由於1996-2007年間的政府更替,有關建議一直未有落實。直至工黨在2007年重掌政權,澳洲政府才正式推行規管改革。20註釋符號代表1996-2007年間,多屆政府由保守派政黨領導,他們反對設立新的規管機構,並傾向對慈善機構採用較傳統和狹窄的定義。請參閱McGregor-Lowndes et al. (2017)。

- 集中規管制度的要點:澳洲在2012-2013年間制定兩條專門法例,分別是《澳洲慈善機構及非牟利機構委員會法》及《慈善法》,藉以推動規管框架改革。主要特點概述如下:

(a) 慈善機構的法律定義:透過《慈善法》,澳洲歷來首次訂定慈善機構的法律定義,適用於所有聯邦法例。簡言之,慈善機構必須是(a)非牟利;(b)只為慈善宗旨而成立;及(c)以公益為目標。此外,《慈善法》列出12項慈善宗旨,包括適用於現代社會的宗旨,例如動物福祉、環境保護和推廣人權。政治方面,慈善機構不可表態支持個別政黨或候選人,但倡議法例和政策改變則列為其中一項慈善宗旨;21註釋符號代表Federal Register of Legislation (2013)。 (b) 單一規管機構:2012年12月,澳洲慈善機構及非牟利機構委員會("慈善委員會")正式成立,編制約有100人,負責監管所有慈善機構的運作,具有調查及執法權力。22註釋符號代表慈善委員會的人員由澳洲稅務局調任,該局在2019年共有員工約19 000人。請參閱Australian National Audit Office (2020)。 如慈善機構違反管治標準(例如將款項用於非慈善用途),慈善委員會可作出警告、罷免負責人員及撤銷註冊。雖然其他政府機構仍須按其職權範圍監管慈善機構的相關事務(如發出籌款活動牌照),慈善委員會可透過分享資訊及協調執法行動,提供協助;23註釋符號代表Murray (2019)。 (c) 供公眾查閱的慈善機構中央紀錄冊:慈善委員會就各種法律形式的慈善機構建立紀錄冊。慈善機構必須註冊後,才可獲得政府資助(如稅項寬減),並須每年按標準格式提交管治及財務資料。24註釋符號代表為免小型慈善機構負擔過重,每年收入少於25萬澳元(140萬港元)的機構只須填寫標準表格,而收入超過100萬澳元(540萬港元)的慈善機構則另須提交經審計的財務報告。請參閱The Treasury (2018)。 有關資料及違規紀錄會上載到"一站式"入門網站,供公眾查閱; (d) 規管協調:為減輕慈善機構的合規負擔,慈善委員會與其他政府機構合作,消除各部門規例不一致之處。此外,慈善委員會在2014年推出名為"慈善機構通行證"的檔案分享服務,讓其他監管機關查閱慈善機構提交的資料,減省重複呈交報告的需要;及 (e) 以認證方式為捐款人提供額外資訊:慈善委員會在2016年推出"註冊慈善機構標籤"認證計劃,協助公眾識別管理妥善、符合透明度和問責性標準的慈善機構。只有合資格的慈善機構,才可在籌款時展示標籤。 - 政策成效:澳洲推行規管改革8年後,似見成效。首先,慈善委員會改善了整體規管效率。2019年12月共有21個政府機關透過"慈善機構通行證"分享慈善機構的資料,為慈善機構節省大量合規開支,2019年的節省款額估計高達1,860萬澳元(1億120萬港元)。25註釋符號代表2014年的顧問研究結果,亦確認向慈善委員會提交的文件只佔慈善機構合規負擔的0.1%。請參閱Ernst & Young (2014)及Australian National Audit Office (2020)。 第二,根據2015年的調查,當地大部分(88%)慈善機構表示支持慈善委員會,肯定其減少重複規管及推廣慈善發展的貢獻。26註釋符號代表1 100受訪慈善機構行政人員中,58%支持由慈善委員會規管,30%支持其與業界共同規管。只有少數支持業界自行規管(7%)或由澳洲稅務局(5%)規管。請參閱Probono Australia (2015a)。 即使澳洲自由黨──國家黨聯盟在2013年大選勝出後,擬取消上述改革,亦因慈善團體的反對而擱置計劃。27註釋符號代表Probono Australia (2015b)。 第三,慈善委員會似可有效維持澳洲慈善團體的多樣性,並無任何機構投訴因政治理由而遭無理針對。28註釋符號代表Murray (2019)。 2013-2019年期間,即使多達19 000個慈善機構(即2019年慈善機構總數的三分之一)於中央註冊紀錄冊中被除名,但它們僅主要由於相關機構停止運作和未能遵守報告規定,而非活動受到審查。29註釋符號代表ACNC (2019)。 第四,澳洲國家審計局在2020年剛發表的審計報告中,認為慈善委員會的規管工作"大致有效"。第五,2013-2017年間,澳洲民眾對慈善機構的信任度,維持在86%-90%的高水平。30註釋符號代表數字指表示中度和高度信任慈善機構的受訪者百分比。請參閱Kantar Public (2017)。

- 不過,仍有意見關注若干有問題的籌款手法(如過度進取的街頭籌款活動,構成公眾滋擾),因而有建議設立澳洲全國適用的籌款活動規管制度。31註釋符號代表The Treasury (2018)。

立法會秘書處

資訊服務部

資料研究組

劉絜文

2020年11月10日

附註:

參考資料:

| 香港

| |

| 1. | Audit Commission. (2017) Report No. 68 of the Director of Audit.

|

| 2. | Financial Services and the Treasury. (2017) Letter to Public Accounts Committee on Government's support and monitoring of charity. 16 May.

|

| 3. | GovHK. (2018) Government announces administrative measures to enhance transparency of charitable fund-raising activities and safeguard donors' interests. 1 August.

|

| 4. | GovHK. (2019) Government introduces logo for charitable fund-raising activities for easy identification. 1 April.

|

| 5. | HKSARG. (2017) The Government Minute in Response to the Report of the Public Accounts Committee No. 68 of July 2017. 18 October.

|

| 6. | HKSARG. (2019) The Government Minute in Response to the Report of the Public Accounts Committee No. 71 of February 2019. 15 May.

|

| 7. | HKSARG. (2020) The Government Minute in Response to the Report of the Public Accounts Committee No. 73 of February 2020. 27 May.

|

| 8. | Inland Revenue Department. (2020a) Departmental Interpretation And Practice Notes No. 37 (Revised): Concessionary Deductions: Section 26c Approved Charitable Donations.

|

| 9. | Inland Revenue Department. (2020b) Tax Guide for Charitable Institutions and Trusts of a Public Character.

|

| 10. | Law Reform Commission. (2013) Charities.

|

| 11. | news.gov.hk. (2009) ICAC issues fund-raising guidelines. 6 October.

|

| 12. | Office of The Ombudsman. (2003) The Investigation Report on the Monitoring of Charitable Fund-Raising Activities.

|

| 13. | Official Records of Proceedings of the Legislative Council. (2018) 17 January.

|

| 14. | Public Accounts Committee. (2018) P.A.C. Report No. 68A.

|

| 15. | 香港政府一站通:《民政事務局局長談政府對慈善機構的監管》,2017年7月12日。

|

| 澳洲

| |

| 16. | ACNC. (2019) ACNC Annual Report 2018-19.

|

| 17. | ACNC. (2020) Australian Charities Report 2018.

|

| 18. | Australian National Audit Office. (2020) Regulation of Charities by the Australian Charities and Not-for-profits Commission.

|

| 19. | Ernst & Young. (2014) Research into Commonwealth Regulatory and Reporting Burdens on the Charity Sector.

|

| 20. | Federal Register of Legislation. (2013) The Charity Act 2013.

|

| 22. | Industry Commission. (1995) Charitable Organisations in Australia.

|

| 22. | Kantar Public. (2017) ACNC Public Trust and Confidence in Australian Charities.

|

| 23. | McGregor-Lowndes, M. (2017) Australia: Co-Production, Self-Regulation and Co-Regulation. Breen, O. B. et al. (ed.). Regulatory Waves: Comparative Perspectives on State Regulation and Self-regulation Policies in the Nonprofit Sector. Cambridge: Cambridge University Press.

|

| 24. | McGregor-Lowndes, M. et al. (ed.). (2017) Regulating Charities: The Inside Story. New York: Routledge.

|

| 25. | Murray, I. (2019) Regulating Charity in a Federated State: The Australian Perspective. Nonprofit Policy Forum. 22 January.

|

| 26. | Probono Australia. (2015a) 2015 Sector Survey.

|

| 27. | Probono Australia. (2015b) Government Not Abolishing ACNC.

|

| 28. | The Treasury. (2011) Consultation Paper - Scoping study for a national not-for-profit regulator.

|

| 29. | The Treasury. (2018) Strengthening For Purpose: Australian Charities And Not For Profits Commission.

|

| 其他

| |

| 30. | Charities Aid Foundation. (2018) CAF World Giving Index 2018.

|

| 31. | Chevalier-Watts, J. (2018) Charity Law: International Perspectives. New York: Routledge.

|

資訊述要為立法會議員及立法會轄下委員會而編製,它們並非法律或其他專業意見,亦不應以該等資訊述要作為上述意見。資訊述要的版權由立法會行政管理委員會(下稱"行政管理委員會")所擁有。行政管理委員會准許任何人士複製資訊述要作非商業用途,惟有關複製必須準確及不會對立法會構成負面影響。詳情請參閱刊載於立法會網站(www.legco.gov.hk)的責任聲明及版權告示。本期資訊述要的文件編號為ISE06/20-21。